Published on 14 October 2025

•

2 min read

A growing appetite for premium dining experiences is driving renewed investment interest in Malta’s restaurant sector, particularly within fine dining and casual upmarket establishments, according to the latest study led by Professor Vincent Marmarà.

The report, which surveyed 250 respondents operating 405 catering establishments between January and June 2025, found that high-spending consumers are becoming increasingly significant to the local restaurant economy. The average customer spend per head rose sharply to €30.16, up from €22.74 in the previous six-month period – with fine dining and casual upmarket venues leading this growth.

High-spending diners drive performance

The study shows a distinct polarisation between price brackets. While the share of customers spending below €15 per head fell from 33.1 per cent to 28.5 per cent, there was a clear shift towards higher-value categories:

Fine dining restaurants reported the highest average spend per customer (€63.84), followed closely by casual upmarket restaurants (€58.18). These segments significantly outperformed casual diners (€27.92) and cafeterias (€10.96), underscoring their importance to investors targeting higher-margin operations.

Investor confidence rebounds

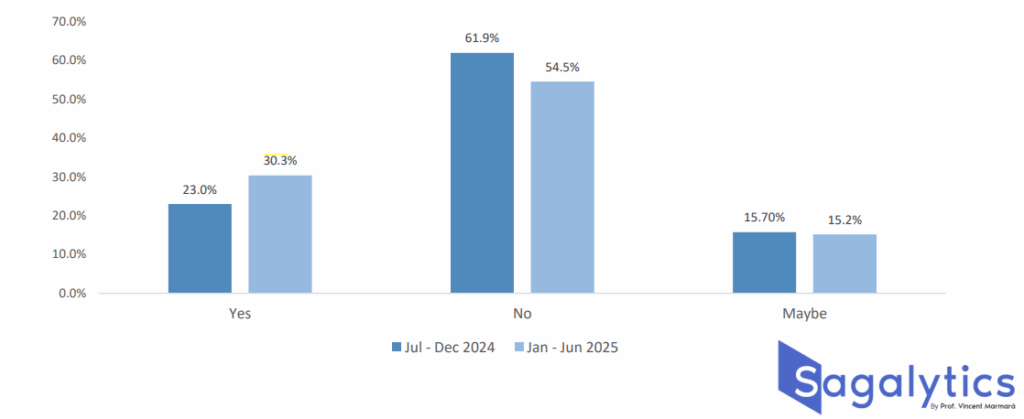

Encouragingly, willingness to invest within the sector has strengthened since late 2024. The proportion of respondents expressing a clear intention to invest in their own or other restaurants increased from 23.0 per cent to 30.3 per cent, while those unwilling to invest dropped from 61.9 per cent to 54.5 per cent.

Notably, this optimism is strongest among fine dining (29.6 per cent) and casual upmarket (30.3 per cent) restaurateurs – suggesting that operators in higher-end markets are regaining confidence in future returns despite cost pressures and workforce challenges.

A similar trend appears in new restaurant ventures, with 21.9 per cent of respondents confirming they had invested in a new establishment within the same twelve-month period, up from 17 per cent in the previous semester. Casual diners and casual upmarket restaurants accounted for the largest share of new openings, reflecting growing diversification within the mid-to-premium range.

Although overall profits saw a modest average decline of 2.4 per cent, fine dining and casual upmarket restaurants fared comparatively well, reporting positive margins of +1.6 per cent and +1.6 per cent respectively. This resilience, combined with higher per-customer spending and a more optimistic investment outlook, signals renewed investor confidence in Malta’s premium dining landscape.

Business Journalist

When she’s not writing articles at work or poetry at home, you’ll find her taking long walks in the countryside, pumping iron at the gym, caring for her farm animals, or spending quality time with family and friends. In short, she’s always on the go, drawing inspiration from the little things around her, and constantly striving to make the ordinary extraordinary.